How Does a Sales Contract Affect Marine Transit Insurance – Everything You Need to Know!

A marine insurance policy serves as a safety net for all parties involved in the transportation business. It includes coverage to protect the policyholder from financial losses in the event of any loss or damage during transit.

However, there are certain contracts in a marine insurance policy that might affect how its coverage works. One such contract is a sales contract in marine insurance.

Through this article, marine insurance policy buyers can understand how the sales contract might affect the terms of their marine transit insurance.

What is Marine Transit Insurance?

Marine transit insurance is a type of insurance that protects against damage or loss to cargo during transportation from the source to the intended destination. This transit insurance primarily covers losses caused during transit, such as fire, hijacking, collision, and overturning.

Moreover, marine transit insurance also protects against third-party liabilities in the event of property damage or bodily harm to third parties. With marine transit insurance, businesses and individuals ensure that their goods are protected throughout the transit process, facilitating smooth trade operations.

What is a Sales Contract in Marine Insurance?

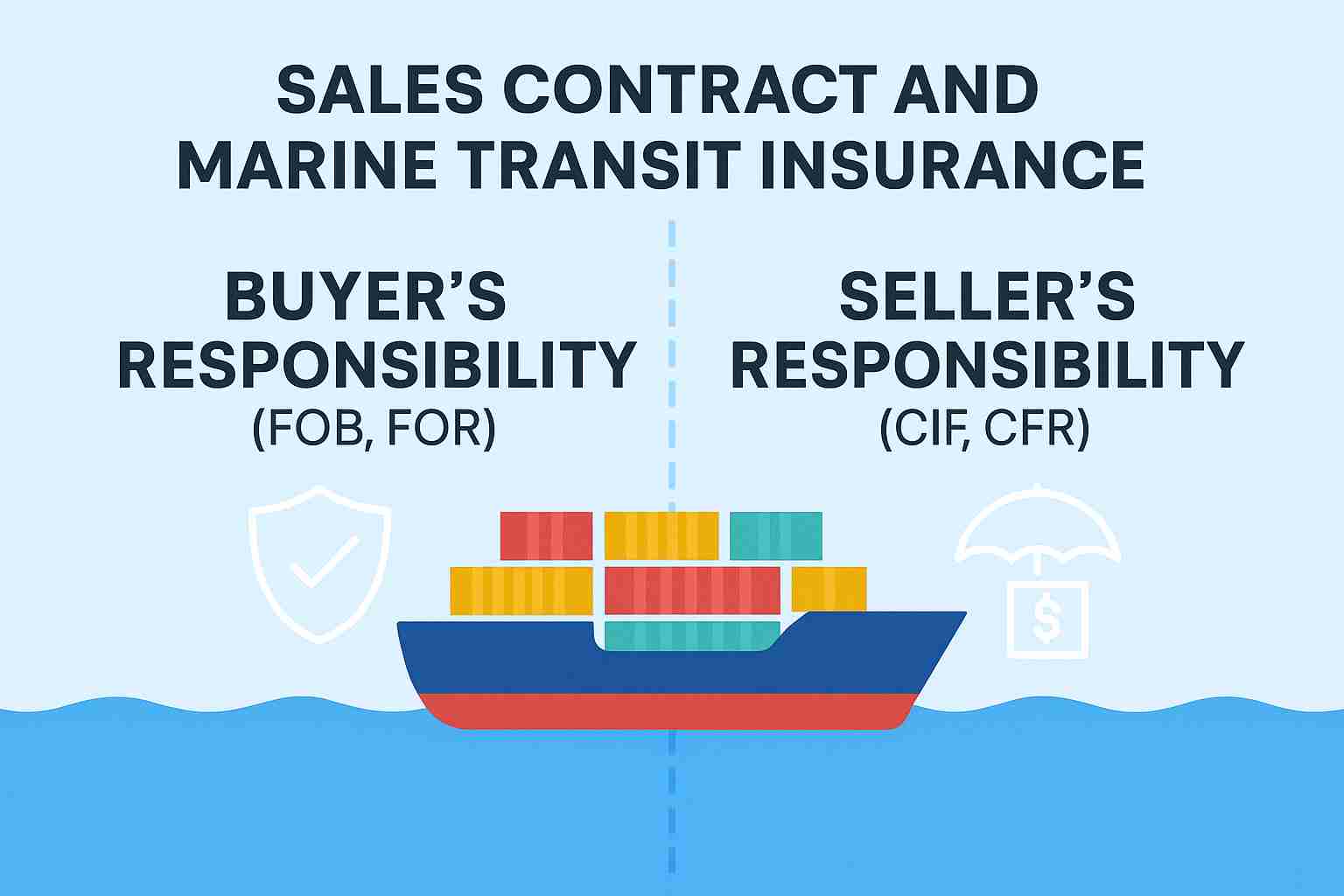

The terms of the sales contract in marine insurance outline loss and compensation, specifying what constitutes a loss and who is entitled to receive compensation. In this contract, two parties are involved: the buyer and the seller.

How Does a Sales Contract Affect Marine Transit Insurance?

Suppose a seller enters into a sales contract with a buyer, and both parties have entered into the contract on a Free on Board (FOB) basis. It means that the buyer shall be responsible for purchasing the marine insurance policy for the goods. As a result, the buyer shall be entitled to receive insurance compensation in the event of loss or damage to the goods.

On the other hand, if the sales contract is based on Cost, Insurance and Freight (CIF), the seller shall be responsible for buying a marine insurance policy. In this case, the seller is entitled to receive compensation from the insurance company for any loss or damage to the goods. Here are the bases on which a sales contract can affect the marine insurance policy:

Free on Board

The Free on Board (FOB) term states that the seller is relieved of the safeguarding duty for goods once they are loaded onto the vessel. It is the buyer’s responsibility to safeguard goods after onboarding; therefore, they need to purchase transit insurance for the goods.

Cost, Insurance and Freight

The Cost, Insurance and Freight states that the seller shall be responsible for safeguarding the goods and thus shall buy a marine insurance policy for goods loaded on the vessel.

Free on Rail

The Free on Rail or ROR contract states that the buyer is responsible for purchasing transit insurance for goods. Thus, they shall receive insurance compensation in the event of loss or damage to the ship.

Cost and Freight

The Cost and Freight contract states that the buyer shall be responsible for purchasing a marine insurance policy for the goods loaded onto the ship by the seller. However, it is worth noting that, under this contract, the buyer has the discretion to purchase the insurance policy at any time.

Example to Understand the Sales Contract’s Effect on Marine Insurance Policy

IC Private Ltd is a clothing brand that exports clothes from India to Canada. These shipments are mostly transported through waterways.

After a few months, IC Private Ltd exported clothes to the buyer in Canada. The company entered into a sales agreement on a Free on Board (FOB) basis. Thus, the buyer in Canada is responsible for the safety of the goods.

Due to bad weather conditions, the goods transported by the ship were damaged and arrived a day later than the scheduled delivery date. The buyer of the goods contacted the insurance company regarding the damage, and the insurer appointed a surveyor to assess the damage that had occurred.

The surveyor assesses the damage and loss incurred by the shipment, then prepares a detailed report of the loss. Once the insurer reviews the report, the claim is settled and received by the buyer. Insights from experienced insurance POS agents.

Summing Up

The sales contract has a significant impact on marine insurance, depending on the type of contract entered into. Whether it is based on Free on Board, Free on Rail, Cost, Insurance, and Freight, each has a different impact on marine insurance. Thus, it is crucial to understand every term of marine insurance specified by the insurer.

Most importantly, choose a trusted insurer like TATA AIG, which provides a marine insurance policy with cargo protection, customisable coverage options, and transparent policies.